The Ride-hailing marketing in Vietnam report from Statista gives an overview of the market and the current situation of the motorbike taxi market in Vietnam. Download the full report or read our article below.

The ride-hailing market in Vietnam is very competitive, with many domestic and foreign ride-hailing service suppliers. With the strong technology development, ride-hailing or hi-tech motorbike taxi - booking applications on phones also develop exceptionally quickly. After Grab entered the Vietnamese market in 2014 and acquired Uber in 2018, the Vietnamese ride-hailing market from 2018 became more exciting. The Ride-hailing marketing in Vietnam report from Statista gives an overview of the market and the current situation of the motorbike taxi market in Vietnam.

According to the report, in 2021, the ride-hailing market size worldwide increased rapidly from 75.39 billion US dollars to 117.34 billion USD compared to 2020. Along with the strong growth of digital 4.0, the internet economy size in Southeast Asia in 2020 reached 62 billion US dollars. Online media account for 17 billion US dollars of the market value; Online Travels showed a lower market share with 14 billion USD and Transport and food with 11 billion US dollars.

In 2025, the value of Southeast Asia's online ride-hailing market is predicted to increase 382%, from 11 billion US dollars in 2020 to 42 billion US dollars in 2025.

Indonesia is the leading country that accounts for the highest market value of the online ride-hailing market in Southeast Asia in 2020 with 5 billion US dollars.

With 5 billion US dollars, Indonesia accounts for the highest market value of online ride-hailing in Southeast Asia in 2020. The next following countries are Singapore (2 billion USD), Vietnam 1.6 billion USD, Thailand 1.1 billion USD Malaysia (1.1 billion USD), Philippines (0.8 billion USD).

The revenue of the ride-hailing and taxi segment in Vietnam increased slowly from 2017 to 2019 from 2.6 to 3.1 million US dollars before falling to 2.1 million US dollars in 2020. The plummeting of the revenue in 2020 was explained by the impact of the COVID pandemic. However, in the context of the epidemic and social distancing, to retain customers and maintain operations during the pandemic, many businesses have promoted the development of delivery and market and household services in 2021. The revenue of the ride-hailing and taxi segment in Vietnam will increase in 2021 to reach 3,115 million US dollars, and growth was stable in the following years and predicted to reach 4,5 million US dollars in 2025.

Most of Vietnam's ride-hailing and taxi revenue from 2017-2025 comes from Offline and tends to move offline to online.

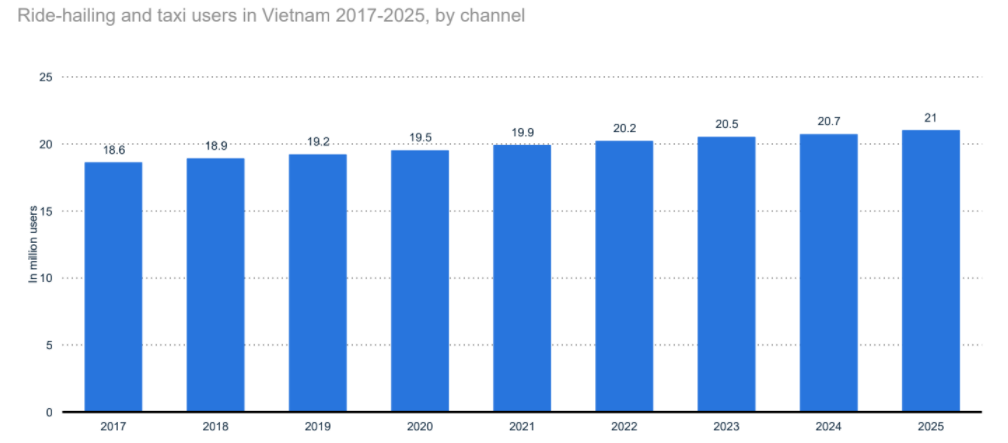

The ride-hailing and taxi users in Vietnam have increased, with 18.6 million users in 2017 and an average increase of 0.3 million users.

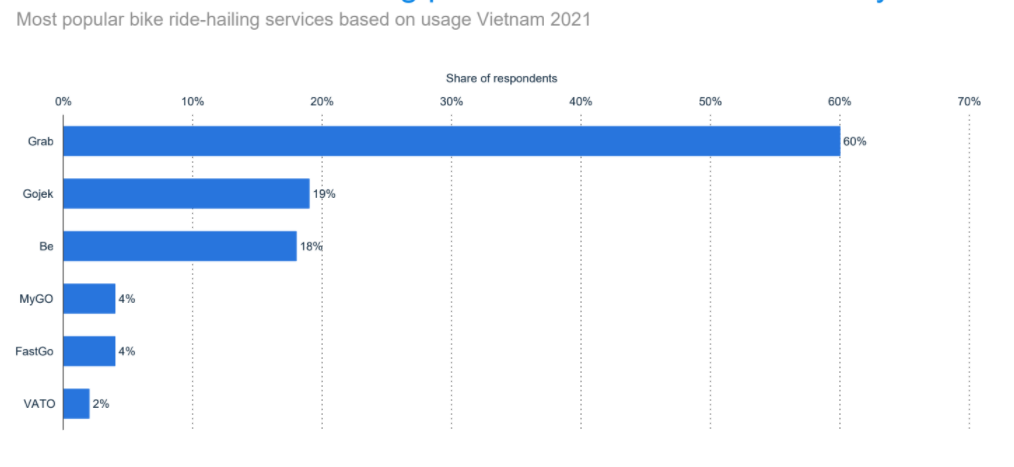

Grab is Southeast Asia's most loved convenient ride-hailing app to provide users with fast transportation services by connecting more than 10 million passengers with 185,000 drivers across the region. In Vietnam, Grab remains the leading platform accounting for 73% of the market share in 2019. The owner for the following position is Be with 16% of the market share and Gojek with 10% of the market share.

Besides the leading platforms above, MyGo, FastGo, and VATO are the other most used bike ride-hailing platforms as of May 2021 share of respondents according to Statista.

Gojek is out of the list of most used car ride-hailing platforms in Vietnam, instead of that are Grab (account 66% share of respondents), Be (22%), FastGo (8%), MyGo (8%), VATO (4%), Others (2%).

Popular ride-hailing apps in Vietnam such as Grab, Gojek, or Behave had a relatively difficult year due to the impact of COVID-19 in Vietnam. The number of Grab rides decreased significantly from 313 million rides in H1 2019 to 62.5 million rides in H1 2020.

According to the report, 33% of people surveyed show they use bike ride-hailing more, while just 6% of respondents showed they use traditional bike taxis more than bike ride-hailing.

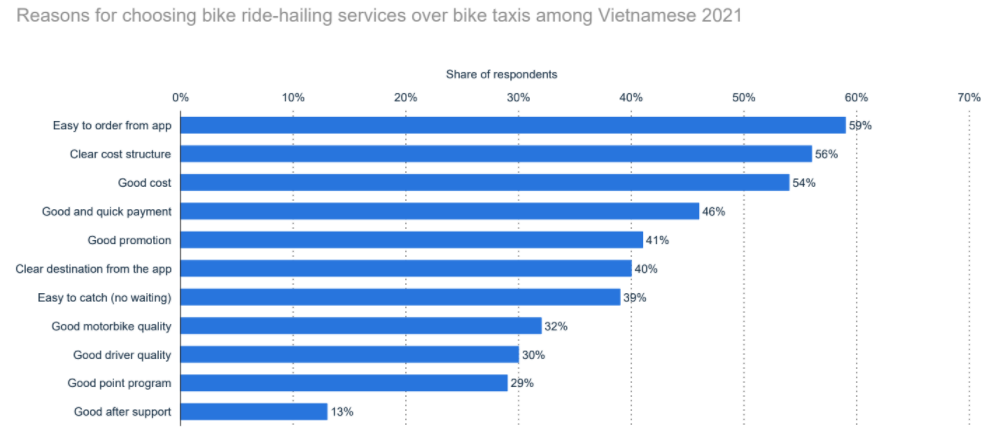

The reasons that made Vietnamese choose bike ride-hailing are mainly by easy to order form apps (59% share of respondents), clear cost structure (56%), Good cost (54%), Good and quick payment (46%), Good promotion (41%), Clear destination from the app (40%), easy to catch (no waiting - 39%), Good motorbike quality (32%), Good deliver quality (30%), Good point program (29%), Good after support (13%).

48% of respondents choose bike taxis over bike ride-hailing services as it is easy to catch (no waiting), 31% choose by good cost, 24% by good and quick payment, etc.

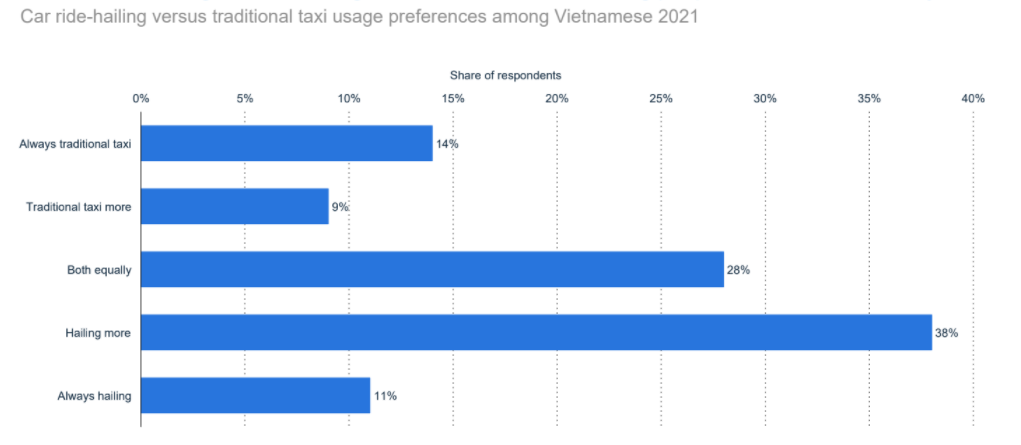

According to the survey, 38% of respondents tend to hail more than traditional taxis, 28% choose both equally, 14% always hail traditional taxis, 11% always hail, and 9% more traditional taxis.

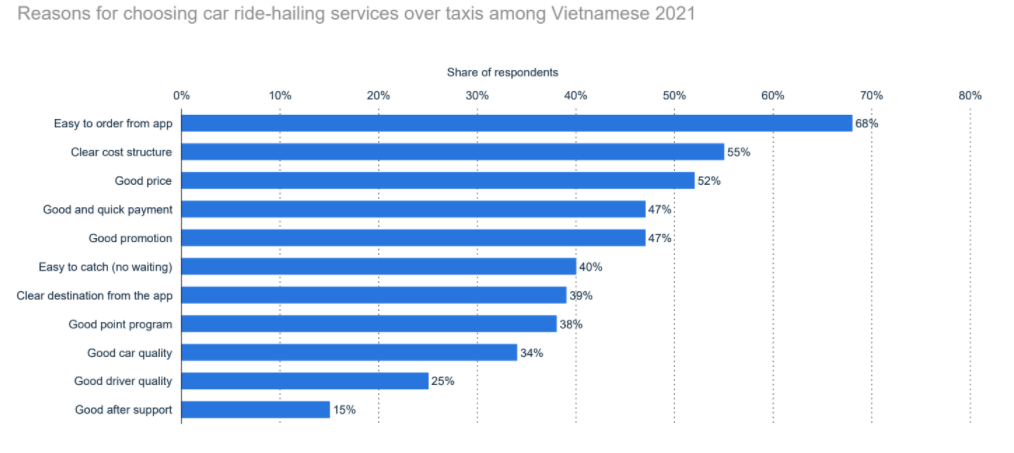

66% of respondents choose car ride-hailing services over traditional taxis because it is easy to order from an app, 55% by its clear cost structure, 52% by a good price, 47% good and quick payment, 47% good promotion, 40% easy to catch (no waiting), etc.

Among people choosing traditional taxis over car ride-hailing, 46% respondents think it is easy to catch, 27% by a good price, 25% by good car quality, 21% clear cost structure, 21% Good and quick payment, 21% Good driver quality, 21% As I do not install the app, etc.

The ride-hailing application development in Vietnam has changed how the traditional bike or taxi market operates. But the pandemic that broke out at the end of 2019 affected the ride-hailing market worldwide and in Vietnam. Responding to the pandemic and changing service types (transporting people to transporting goods), prioritizing cashless payment methods (credit cards, e-wallets) over the traditional cash, ensure safety and survival well during the pandemic. Download the full report to explore the detailed data of the ride-hailing market in Vietnam.