This report will bring you an overview of the Fintech Industry in Vietnam and what your businesses can benefit from it. Download the Fintech report here or read our analysis article below.

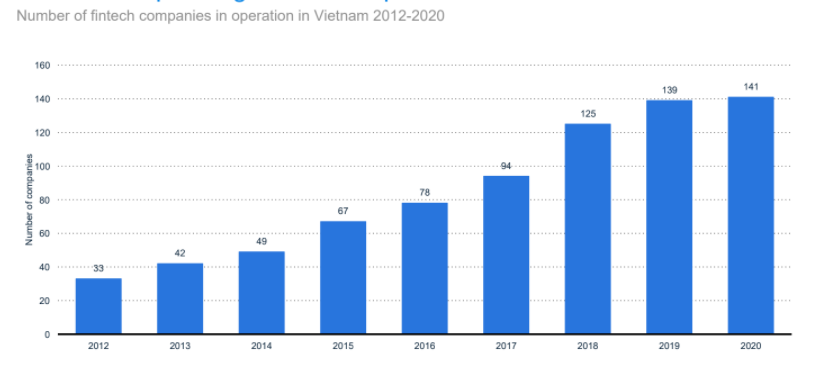

Fintech has marked many outstanding developments in recent years. According to Statista's report, the number of operating fintech companies in Vietnam's fintech sector has doubled from 2016 to 2020. Specifically, Vietnam had 78 operating fintech companies in the fintech industry in 2016; by 2020, this number will be 141. The Fintech in Vietnam 2020 Report will focus on analyzing the current situation of the domestic Fintech sector, and at the same time, share the main trends of the industry and the local Fintech startup ecosystem in the Asia Pacific.

According to Statista's report, the total value of fintech investments in the Asia Pacific tripled from 2017 at 13.6 billion US dollars to 36.6 billion US dollars in 2018. The value showed a substantial decrease in the following years, with the investment value at 16.8 billion US dollars and 11.6 billion US dollars in 2020.

China has the most significant transaction value of digital payments in the Asia Pacific in 2020 of 2,309 billion US dollars, while Vietnam had the smallest amount of 8.6 billion US dollars (ranked below India, Australia, Indonesia, Singapore, Hong Kong, and Malaysia).

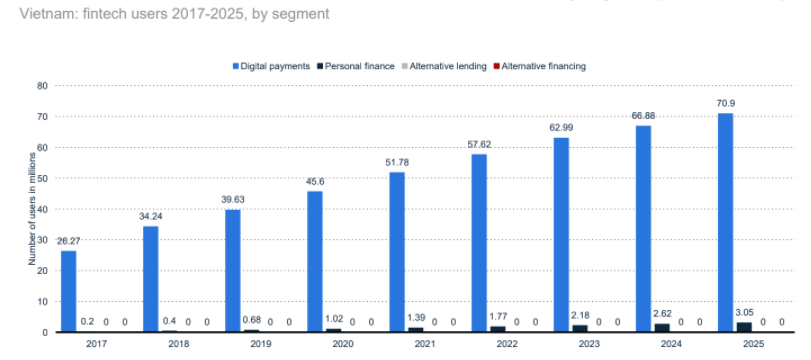

The transaction value of the fintech sector in Vietnam reached US$11,607 million and will increase rapidly to reach US$18,172 million in 2020. This number was predicted to increase to 26,378 million US dollars in 2025. Along with the increase in transaction value, the number of users of the fintech sector in Vietnam increased rapidly through the years. This shows that, although the Fintech sector in Vietnam is growing In the early stages of development, this field has received significant attention due to the government's active support for innovation, helping Vietnam become an attractive investment destination, full of potential for foreign investors.

It can be said that the number of users in the Fintech sector in Vietnam has continuously increased year by year. In 2015 the whole market had only 67 companies (this number increased to 94 respectively in 2017 and 141 in 2020).

In terms of the target audience, Fintech companies in Vietnam can be divided into 2 main groups. The first group is solutions for end-users/individual investors, providing digital tools to improve/enhance the experience for payment transactions, consumer loans or investments, etc. The majority of Fintech's companies in Vietnam are working towards this audience. The other group, which is less active, are "back-office" companies, providing technical support to financial institutions/issuers/distributors.

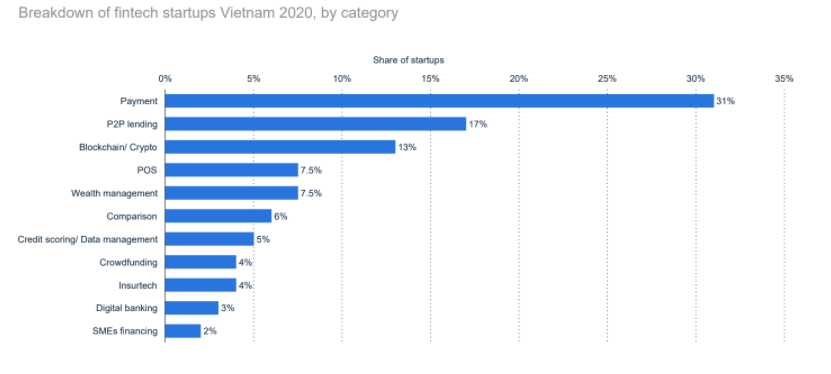

In terms of products/services, the market is divided into many segments, typically: payment makes up the majority accounting for 31% of Vietnam's fintech startups, peer-to-peer lending (P2P lending) category accounting for 17%, and 13% of the blockchain/ crypto field, others fintech categories following by POS (accounting for 7.5%), Wealth Management, Comparison, Credit scoring/Data management (5%), Crowdfunding (4%), Insurtech (4%), Digital Banking (3%), SMEs financing 2%.

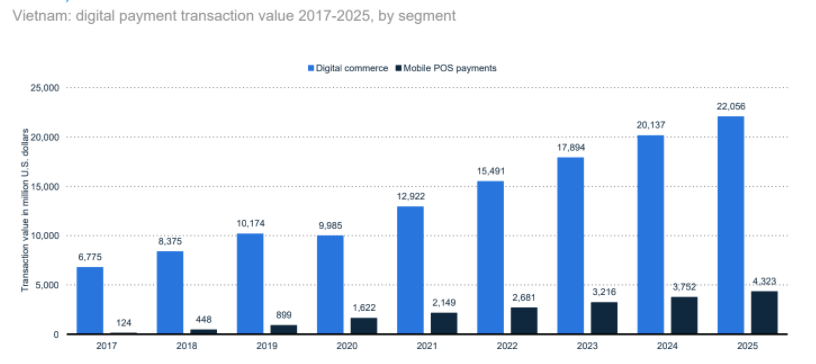

According to the report, the transaction value of digital payments in Vietnam increased steadily and rapidly throughout the period years from 2017 to 2021. As of 2021, the transaction value of digital payments in Vietnam reached 12,922 million US$; this number in the previous year was 9,985 million US$ and is predicted to increase to 22,056 million US$ in 2025.

With the 5 largest e-wallets being: MoMo, Payoo, Moca, ZaloPay, and ViettelPay, the transaction value of e-wallet in Vietnam will increase enormously in 2019, reaching 10.4 billion US dollars. The mobile banking transaction value was at 240 billion US dollars in the same year.

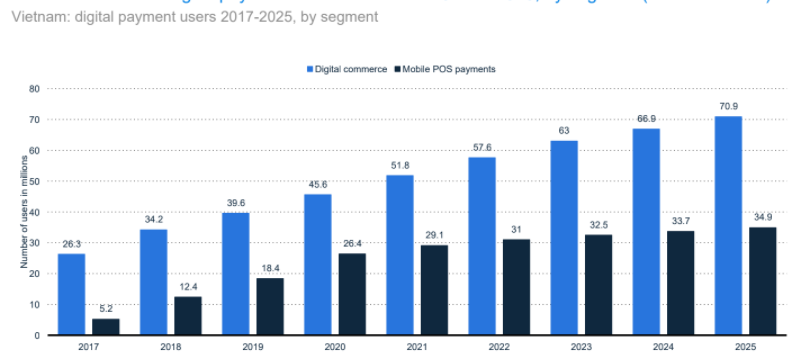

In 2017, Vietnam had 26.3 million digital commerce payment users; this number in the Mobile POS payment segment was 5.2 million. The digital commerce payment users increase double to reach 51.8 million users in 2021, while Mobile POS payments users increase 5.6 times with 29.1 million users in 2021. The number of Digital commerce payment users is predicted to increase by 70.9 million in 2025, while Mobile POS payment users will reach 34.9 million in 2025.

On average, the digital payment transaction value per Vietnamese user in Digital commerce in 2017 was 257.9 US$; this number in Mobile POS payment was 223.7 US$. In 2020, the average transaction value per digital commerce payment user showed a decrease of 25% to 219US per user.

The 4.0 technology revolution and Fintech trend promote the strong and highly competitive development of online lending solutions, bringing significant challenges to the traditional banking community. If commercial banks do not actively apply new technologies and boldly invest in modern equipment, they will lose market share and customers.

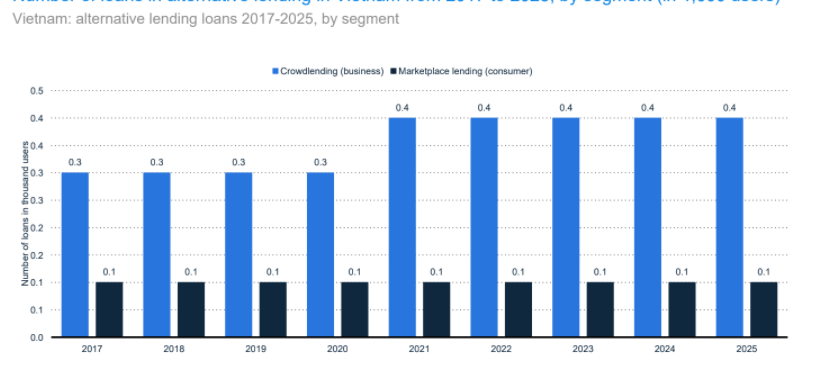

According to the report from Statista, the alternative lending segment in Vietnam is divided into two groups: Crowdlending and Marketplace lending. The transaction value of alternative lending in the Crowdlending segment in Vietnam was at 0.6 million US dollars; this number in the Marketplace lending segment was 0.1 million US dollars in the same year. In 2020, the transaction value in Crowdlending increased 50% to reach 0.9 million US dollars, while in Marketplace lending, the transaction value remained 0.1 million US dollars.

In general, the number of loans in alternative lending in Vietnam does not significantly change with the number of loans around 0.3 thousand users in 2017 to 2020 in Crowdlending and 0.1 thousand users in Marketplace lending. This number was predicted to increase to 0.4 thousand users from 2021 to 2025 in Crowdlending and 0.1 thousand users in Marketplace lending.

The average funding per loan in alternative lending in Vietnam steadily increased through the period years from 2017 to 2021. In 2017, the average funding per loan in Crowdlending was at 0.6 US dollars and 0.1 US dollars in Marketplace lending.

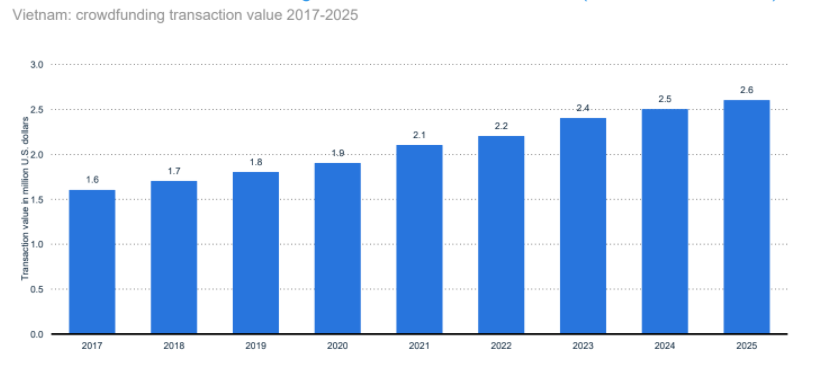

In 2017, the transaction value of Crowdfunding in Vietnam reached about 1.6 million USD; up to 2020, the transaction value of this method has exceeded 1.9 million USD. And this number is predicted to have the fastest growth rate, reaching about 137%, and get 2.6 million US dollars in 2025. Besides, the number of crowdfunding campaigns increased from 2017 to the highest in 2021 and is predicted to decrease for the following years.

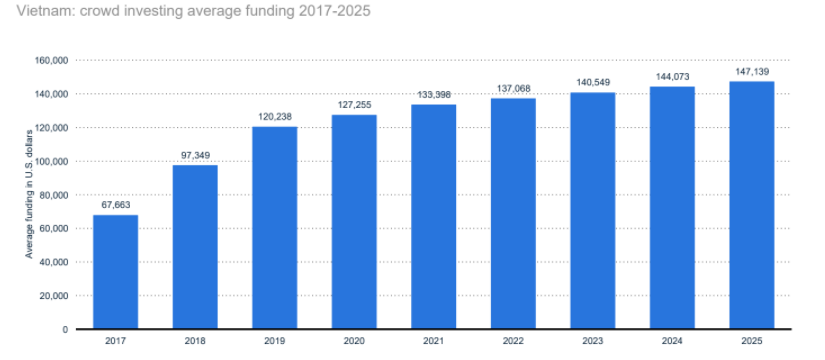

In Crowd Investing in Vietnam, the transaction value was at 0.1 million US dollars in 2017; this number was increased to 0.4 million US dollars in 2021 and predicted to get 0.6 million US dollars in 2025. The average funding of crowd investing in Vietnam was recorded at 67,663 US dollars in 2017 and increased to more than 133 US dollars in 2021, with a high growth rate of 199%.

The report showed that in Vietnam, more than 47% of people surveyed in Vietnam have known about digital borrowing, 39% are aware of digital money, and 36% know digital lending. In E-banking and E-payment, men tend to recognize and use these services more than women. Meanwhile, in E-transfer, the level of acceptance of female fintech services is higher. In Vietnam, the group of people with high incomes from 190 million VND accepting fintech services is nearly 3 times higher than the middle-income group from 85-190M VND and 7 times higher than the low-income group below. 85M VND.

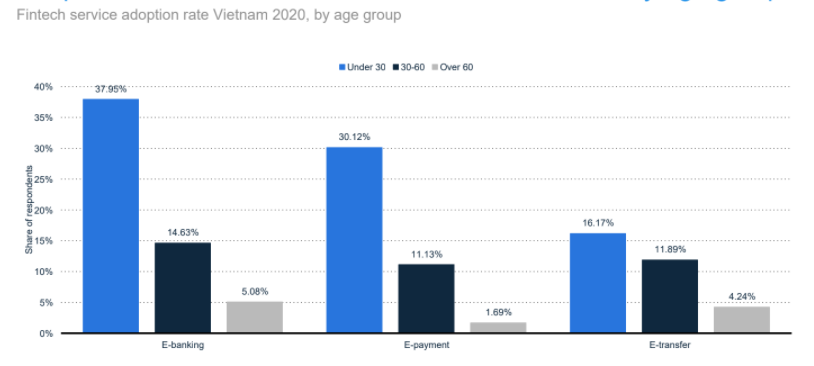

According to a FinTech News; Asian Development Bank survey conducted in June 2020, the percentage of people adoption of fintech services in Vietnam divided by age groups is highest in the group of aged under 30 with 37.95%, aged from 30-60 was 14.63% and over 60 years old accounting for 5.08% in E-banking. This ratio is similar in fintech services groups, including E-payment and E-transfer.

The newest report from Statista shows that Vietnamese have a high awareness and adoption of the Fintech services and e-wallets, although cash is still leading in all payment segments in Vietnam. In the upcoming years, the personalization of digital financial services will be essential. Besides, the post-pandemic non-cash payment habit will not only be maintained but will continue to be promoted in Vietnam.