The development of Fintech in Vietnam has grown stronger than ever under the effects of the pandemic. Find more interesting data about the E-wallet market in Vietnam in the article below.

The development of Fintech in Vietnam has grown stronger than ever under the effects of the pandemic. As of 2021, Vietnam is one of the countries with the highest electronic payment growth globally, reaching the rate of 30.2% annually in the period 2020 - 2027. Find more interesting data about the E-wallet market in Vietnam in the article below.

According to the E-wallets in Vietnam report, the transaction value of digital payments in Asia from 2017 to 2025 increased rapidly. The transaction value reached more than 2,200 million US dollars in 2021 and doubled compared to 2017 (about 1,100 million US dollars). The transaction value is predicted to reach more than 3000 million US dollars in 2025.

Vietnam ranked 8th in the list of countries of the transaction value of digital payments in the Asia Pacific in 2020 with 8.6 billion US Dollars, 268 times lower than China (2,309 Billion US Dollars). And behind other countries in the Asia Pacific area, including India (74 Billion USD); Australia (53.8 Billion USD); Indonesia (35.7 USD Billion); Singapore (15.4 Billion USD); Hongkong (14.5 USD Billion); Malaysia (12.3 Billion USD).

89% of Vietnamese people are surveyed without cash payment; this rate equals the number of surveyed people for similar results in the Philippines. In the list of countries surveyed on Cashless Payments Adoption Rate SEA 2020, Vietnam ranked behind Singapore (98%), Malaysia (96%), Indonesia (93%), Vietnam and Philippines Same with 89%; Thailand (87%), Myanmar (64%), Cambodia (40%), etc.

The transaction value of mobile wallets in Vietnam had impressive numbers, with 14 billion US dollars in 2020 and predicted to reach 48.6 billion US dollars in 2025.

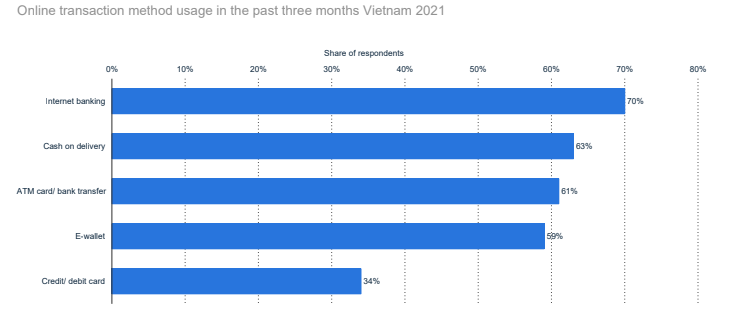

Internet banking is the usual online transaction method used by many people according to the research in 2021 shared by 70% of respondents; Cash on delivery (63%); ATM card/ bank transfer (61%); E-wallet (59%); Credit/ debit card (34%).

In Vietnam, the level of use of popular e-wallets in significant cities. According to the city's e-wallet usage in the past three months in 2021, 64% of Hanoi people surveyed using e-wallets, this rate in Ho Chi Minh City is 68%, other provinces 42%, all country 59%.

The number of mobile wallet users in Vietnam in 2020 reached 19.2 million people, according to Statista's report, and forecast the number of mobile wallet users in Vietnam in 2025 will reach 57 million people. The number of e-wallet apps in use among users showed that 44% of respondents use 2 apps, 39% use 1 app, and 18% use 4 apps and above.

In recent years, in the Vietnamese market, financial technology companies (Fintech) have competed fiercely for this lucrative market share when launching a series of e-wallets brands such as Momo, Samsung Pay, VTC Pay, Bank plus, Payoo, ZaloPay, 1Pay, Bao Kim, Vimeo, Mobivi, eDong, FPT Wallet, eMonkey, Pay365, TopPay, Ngan Luong, AirPay,...

With nearly 40 different e-wallets, 6 prominent e-wallet brands include Momo, ZaloPay, ViettelPay, Shopee Pay, Moca, and VNPTPay. According to the report from Statista, Momo is the most popular mobile wallet brand in Vietnam 2020, account 53% of the market shared; the following mobile wallet brands are ViettelPay (25.2%)l AirPay (10.6%); ZaloPay (5.3%); Others (4%); GrabPay (2%).

The research conducted in October among e-wallet users nationwide of 589 respondents shows that Momo is the most popular e-wallet brand in Vietnam, shared by 86% of respondents; ZaloPay (64%); ShopeePay (AirPay) (48%); ViettelPay (45%); Moca (20%); VNPT Pay (12%).

According to the report, Momo is a prominent e-wallet popularly used by Generation Z (54%); Millennials (59%); GenX (47%); while ZaloPay is the second most popular app in the GenX group, while the GenZ and Millennials group is ShopeePay (AirPay). ShopeePay exploits its competitive advantage (USPs) as an integrated payment platform in the market-leading e-commerce platform. This also shows that ShopeePay users have a higher shopping demand on the e-commerce platform of the same name than GenX (whose rate of ShopeePay users is 1%).

MoMo again shows its strength in diversifying services, payment utilities, and affiliate partners. Besides, VNPAY owns a "remarkable" network of payment affiliate partners with the electronic payment gateway platform's solid strength. Zalmay with the advantage of converting users directly to the Zalo Chat application. ViettelPay's telecommunications ecosystem allows money transfer via phone number. Moca (GrabPay) with the Grab super app ecosystem. SmartPay with a specific customer group is small businesses and SMEs.

According to a survey by the World Bank, in 2021, Vietnam will be in the top 3 countries, with the proportion of users of mobile payment applications accounting for 29.1% of the market share. As of the end of the first quarter of 2020, Vietnam had nearly 13 million e-wallet accounts and 225 million transactions.

With the rapid development of financial technology and smart devices, and the impact of the pandemic forcing people to choose safer payment methods over cashless, 35% of people surveyed said they use e-wallets 3-5 times per week, 21% use e-wallets every day, 18% use 2-3 times per month and 12% use weekly, only 2% of users once a month or less than once.

The survey of 589 respondents; among e-wallet users nationwide according to the report from Statista shows that 24% people spend from 100,000 to 500,000 VND; 23% people spend from 500,000 to 1,000,000 VND; 14% people spend from 1,000,000VND to 1,500,000 VND; etc.

With the strong development of financial technology and the impact of the pandemic driving the strong demand for e-wallets, businesses that want to succeed need to seize the opportunity by implementing mobile payment integration as fast as possible if they want to retain and find new customers. Download the E-wallets in Vietnam report here.