Digital marketing and social media development have significantly impacted the adoption of beauty trends by Vietnamese people globally. Find more interesting information about the cosmetic market in Vietnam and the opportunities for cosmetic brands.

The report from Statista gives us an overview of the cosmetics market in Vietnam. According to Nielsen research, Vietnamese spending on cosmetics still has room to thrive in the coming years. Digital marketing and social media development have significantly impacted the adoption of beauty trends by Vietnamese people globally. Let's find out more about the cosmetic market in Vietnam and the opportunities for cosmetic brands in the coming years.

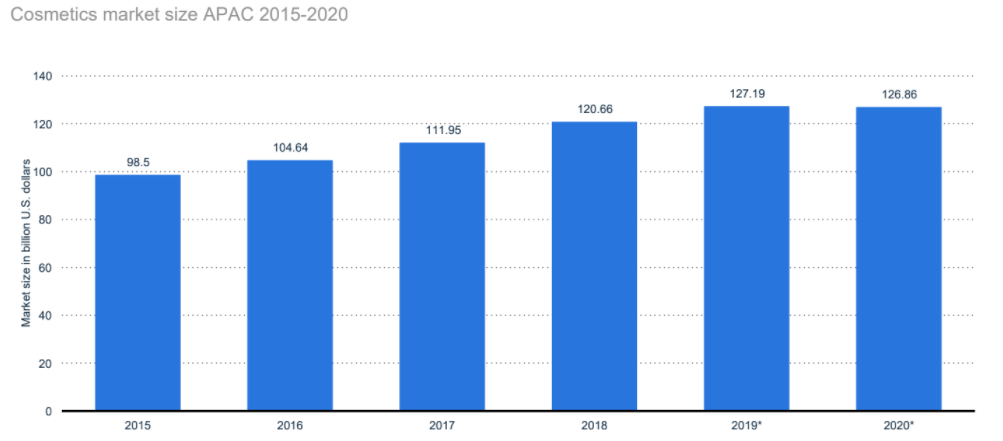

According to the report, the cosmetics market size in the Asia Pacific region has grown steadily over the years, with an average growth rate of 5.23% per year. The Asia Pacific cosmetics market size in 2020 was 126.86 billion USD, an increase of 28.36 billion USD compared to 2015.

Vietnam's cosmetics market grew 1.3 times, from about 1.78 billion USD in 2016 to 2.35 billion USD in 2018. The revenue of the Vietnamese cosmetics market was worth 8.3 trillion VND in 2018, nearly double the revenue in 2013 (4.2 trillion VND).

Beauty stores (21%), Online (19%), General trade (19%), Street shops (18%) are the main channels of beauty product sales in Vietnam from June 2018 to June 2019, according to the report. Other channels include Wet market (8%), Ministore (4%), Supermarket (9%), Others (2%).

In 2018, the most significant Vietnamese cosmetic product exported to Japan accounted for 120.36 million USD, followed by India with a total value of 75.39 million USD. Import value of beauty care products of Vietnam, mainly from Singapore, reached 278.67 million USD in 2018, Thailand accounted for 116.45 million USD, China 61.74 million USD, etc.

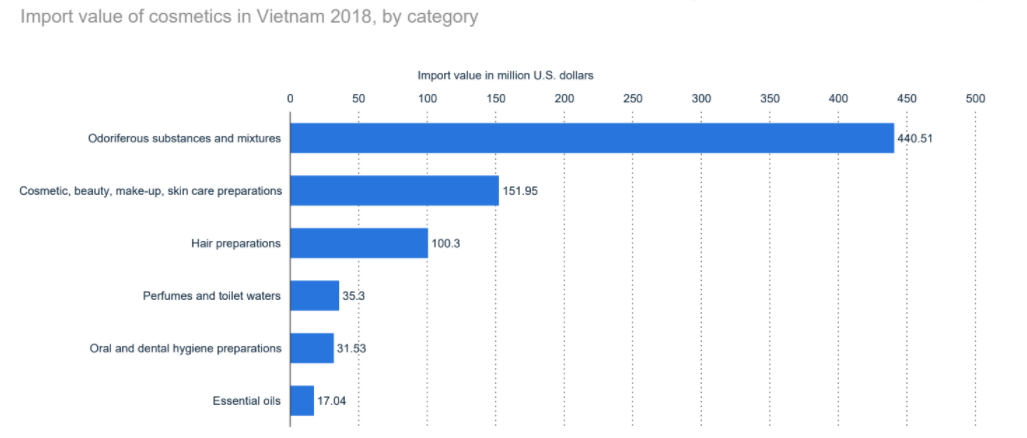

The main imported products belong to the category Odoriferous substances and mixtures (with an import value of 440.51 million USD in 2018); Cosmetic, beauty, makeup, skincare preparations (US$151.95 million); Hair preparations (100.3 million USD); Perfumes and toilet waters ($35.5 million); Oral and dental hygiene preparations ($31.53 million); Essential oils ($17.04 million).

Vietnam is the leading country with market size of nearly 9.7 million USD in 2018 and is predicted to increase 74% to reach 16.785 million US dollars in 2022. Malaysia is the next follower with a market size of 5.77 million USD; other countries in the ASEAN region include Thailand (5,170.4 million USD); Indonesia ($5,064.3 million); Philippines ($4.876 million); Singapore ($1,639 million); Cambodia ($585.9 million); Laos (85.8 million USD).

The survey was conducted with 458 female customers nationwide about the most popular cosmetics shopping channel in 2020 ranked as follows Department stores (41%); Brand stores (39%); Online websites (38%); Supermarkets (38%); Cosmetic shops (36%); Overseas (24%); Facebook shops (23%); Showrooms (15%). From friends (14%); Drug stores, beauty stores (13%); Nearby local shops (9%), Convenience stores (9%).

As of Jan 2020, the most popular beauty brands used among female consumers in Vietnam are Nivea (55% share of respondents); Pond’s (51%); The Face Shop (37%); Innisfree (37%); Acnes (33%); L'oreal Paris (32%); Hada Labo (30%); Maybelline (30%); Vichy (27%); 3CE (26%); Rohto (25%); Laneige (23%); Shiseido (22%); Ohui (20%); etc.

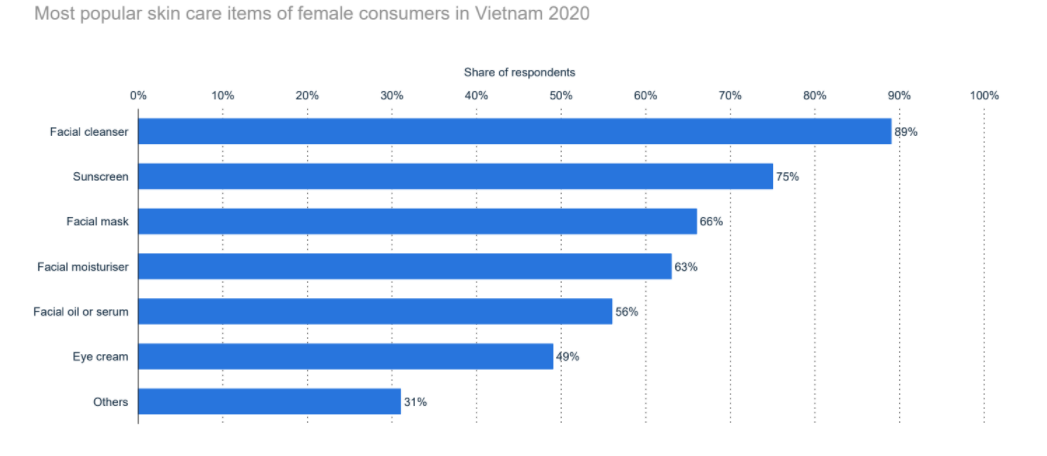

The most used skincare products are facial cleanser (89%), sunscreen (75%), facial mask (66%), facial moisturizer (63%), facial oil or serum (56%), eye cream (49%), and others (31%). The remarkable thing is that the surveyed people gave the most reason for not using skincare cosmetics because they did not know which type to choose (32%), higher than being too busy to take care of their skin.

According to the survey, lipstick is the most used and most popular product because it is the indispensable daily item for women; the following are Eyebrows, Mascara, Foundation, Blush, Makeup base, Face powder, Concealer, Eye shadow, Cushion Foundation, Lip gloss, etc.

The majority of Vietnamese women own combination skin (35% of people surveyed), oily skin (28%); normal skin (20%); dry skin (8%); sensitive skin (8%). This feature affects more or less how to choose skincare products and makeup habits.

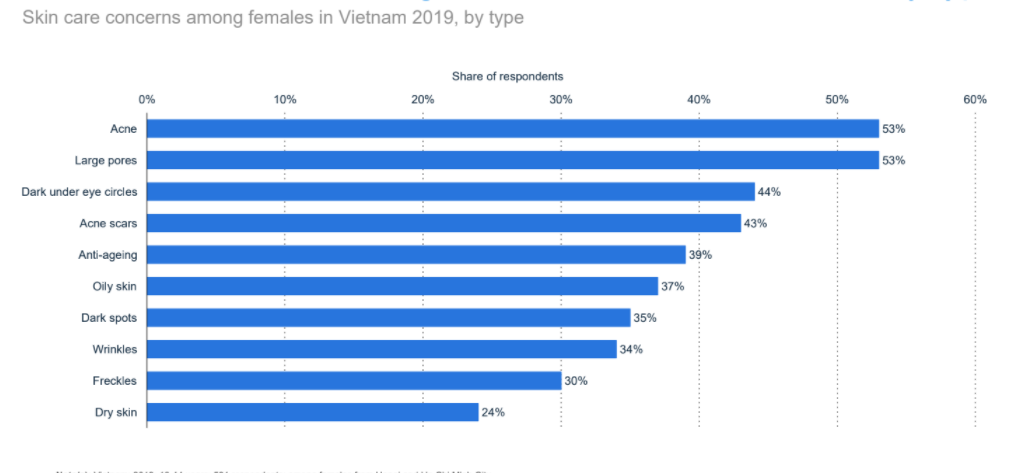

The survey among 531 females from Hanoi and Ho Chi Minh City shows that key skincare issues are mainly acne (53%), enlarged pores (53%), dark under-eye circles (44%), acne scars (43%); anti-aging (39%); oily skin (37%); dark spots (35%); wrinkles (34%); freckles (30%); dry skin (24%).

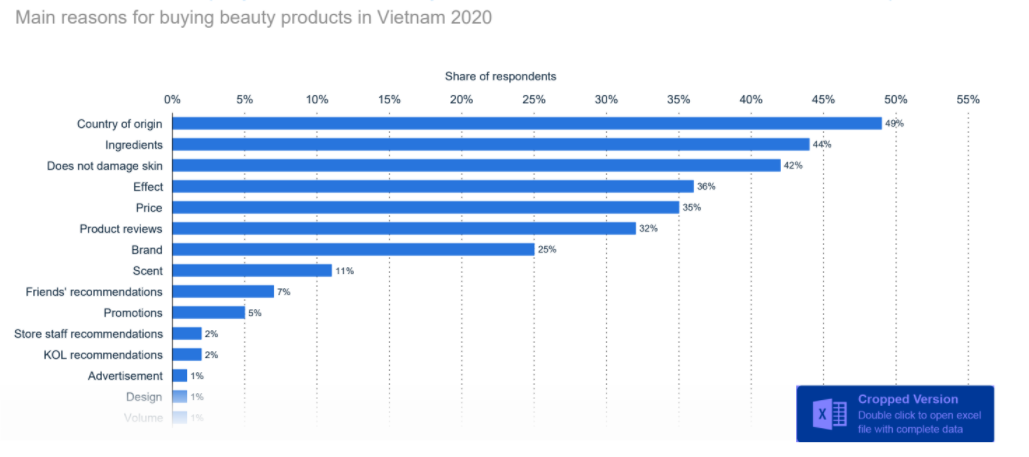

The main factors for buying cosmetics among female consumers in Vietnam was mainly based on Country of origin (account for 49% of the respondents); Ingredients (44%), Does not damage skin (42%), Effect (36%), Price (35%); Product reviews (32%); Brand (25%); Scent (11%); Friends' recommendations (7%); Promotions (5%); Store staff recommendations (2%); etc.

The survey also shows 53% of the respondents use skincare products every day, 14% use 2-3 times a week, 12% do not use skincare products, 8% 4-6 times a week, 5% once a week, 4% less than once a week and 4% special occasions only.

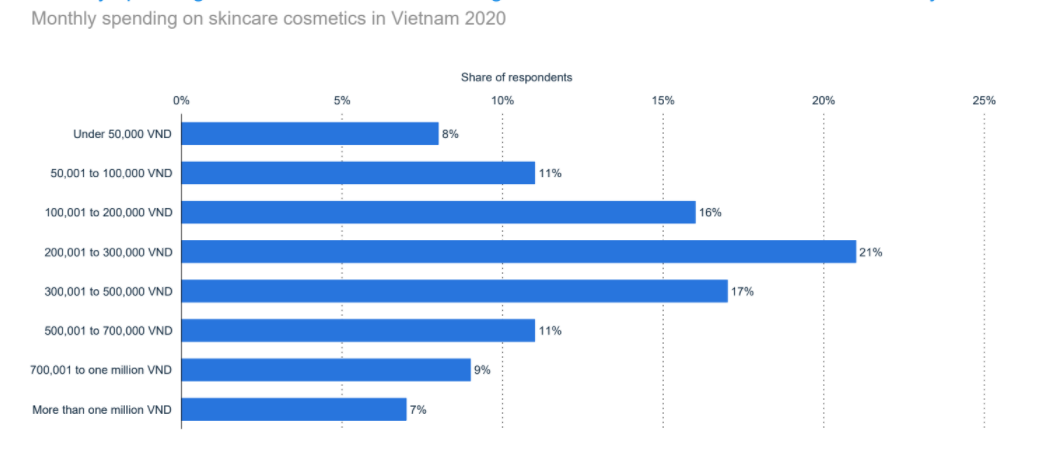

According to a survey in the report by Statista, the average amount that Vietnamese women spend on skincare cosmetics is 436,000 VND per month:

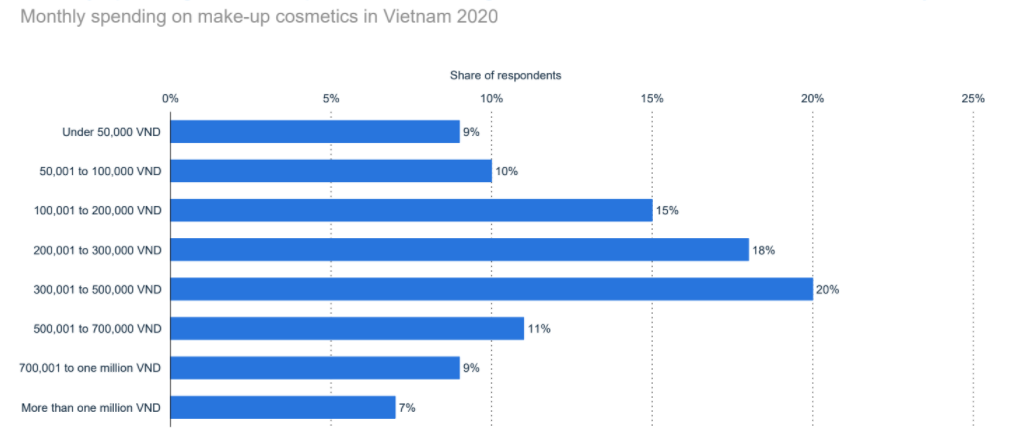

On average, female consumers spend more money on makeup than on skincare, with spending ranging from VND 300,000 to VND 500,000 accounting for 20% of the respondents, 18% spend 200,000-300,000 VND per month. 32% of the respondents reveal they wear makeup on special occasions only, 28% wear makeup daily.

With the development of e-commerce, selling on social networking channels such as Facebook, Instagram, Tiktok, and e-commerce platforms such as Shopee, Lazada, Tiki, Sendo, etc., quickly became a popular shopping channel.

According to the survey conducted in Vietnam; January 2020 of 58 respondents; among female consumers who buy cosmetics online, 26% of respondents reveal they buy cosmetics products online once every two to three months; 21% once every two to three weeks, 19% once a month, etc.

The most popular e-commerce websites for purchasing beauty care products among Vietnamese are Shopee, Tiki, Lazada, Sendo, Innisfree. Facebook is the most popular social media platform to purchase cosmetics; other platforms are Instagram, Zalo.

Buying and paying online provides a great experience that saves time and money. Besides, most online shoppers will use promotional campaigns to shop more economically.

The Vietnamese cosmetic market is predicted to grow stronger in the future thanks to digital technology and the impact of the pandemic. This brings opportunities and challenges for domestic as well as international businesses. You can download the free report here to explore the market data deeply.