The Tourism in Vietnam Report from Statista provides an overview of the tourism market in Asia in general and Vietnam in particular through detailed data.

Vietnam possesses attractive tourism development potential and is a destination attracting tourists worldwide. However, before the pandemic, Vietnam's tourism industry was inevitably severely affected. The Statista report provides an overview of the tourism market in Asia in general and Vietnam in particular through detailed data.

According to the report, China ranks No. 1 of the international tourist arrivals in Asia with 33.28 million of the international tourist arrivals in 2020; the second rank belongs to Thailand with 14.86 million arrivals, Japan ranks No.3 with 9.17 million, and Vietnam ranks No. 6 with 6.83 million of arrivals.

In 2021, international visitors to Vietnam were estimated at 157.3 thousand arrivals, down 95.9% over the previous year; the number of domestic tourists reached about 40 million; total revenue from tourists reached VND 180,000 billion VND.

For the international tourism expenditure per capita, Singapore ranks No. 1 with 1,550.62 US dollars per capita, Brunei Darussalam ranks second with the expenditure of 466.87 US dollars per capita, etc.

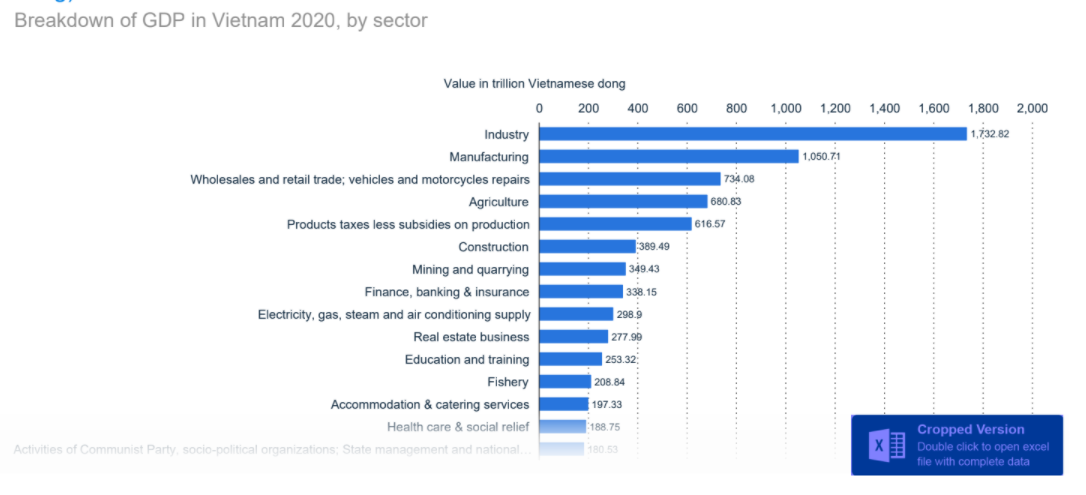

In Vietnam in 2020, Industry is the primary sector that contributes 1,732.82 trillion VND to the GDP of the country, followed by Manufacturing contribute 1,050.71 trillion VND; Wholesales and retail trade; vehicles and motorcycles repairs (734.08 trillion VND); Agriculture (680.83 trillion VND); Products taxes fewer subsidies on production (616.57 trillion VND); Construction (389.49 trillion VND); and more.

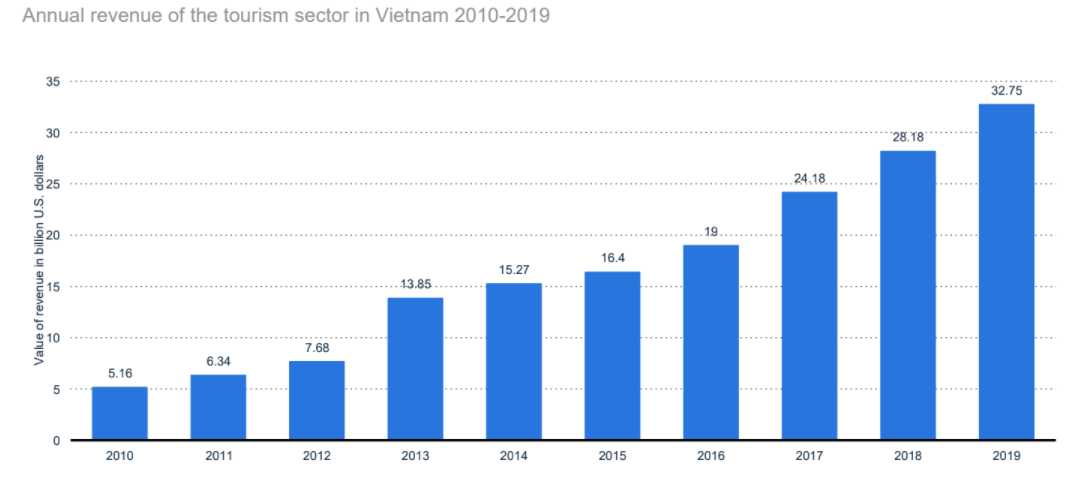

According to the data, the share of direct GDP contribution from the tourism sector in Vietnam steadily increased over the years from 2015 to 2019. The annual revenue from the tourism sector in 2019 reached 32.75 billion US dollars, an increase of 4.57 billion USD compared to the previous year.

In 2021, the epidemic broke out throughout the 64 provinces and cities, forcing Vietnam to apply isolation measures to block and limit flight routes. As a result, in 2021, the number of tour operators applying to revoke business licenses accounted for over 35% of the total issued, while the rest stopped operating.

The number of international visitor arrivals in Vietnam in 2020 was 3.83 million, a decrease of 14.17 million arrivals compared to 2019 due to the pandemic. 81% of international tourist arrivals (ITA) in Vietnam in 2020 are transported by air, 16% travel by road, and 3% by sea.

Of 3.83 million visitors to Vietnam in 2020 were mainly from China and Korea with more than 1.8 million arrivals (accounting for about 50%), China (959.24 thousand ITAs), and South Korea (840.04 thousand ITAs). Visitors from Europe included the United States (174.08 thousand ITAs), Canada (42.2 thousand ITAs), etc.

An international tourist spent 117.8 US dollars daily in Vietnam in 2019; this number increased 22.7% compared to the previous year. The overnight visitors (including package-tour and self-arranged) stay around 8 days at commercial accommodations, while overnight visitors stay around 12 days. at non-commercial accommodations

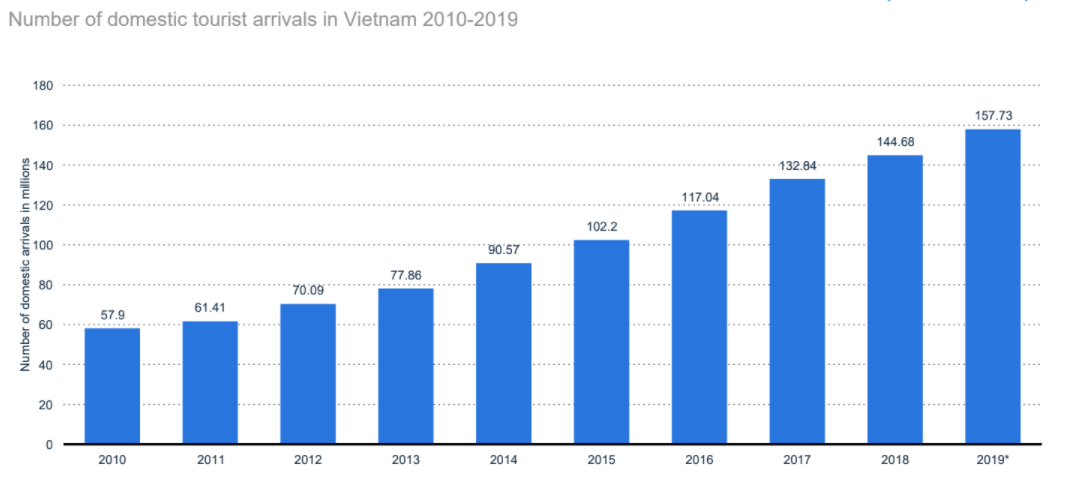

The number of domestic tourist arrivals in Vietnam increased over the year: in 2019, it was 157.73 million arrivals; in 2018 was 144.68 million arrivals; in 2017 was 133.84 million arrivals. In 2019, a domestic tourist in Vietnam spent 1,1223 thousand dongs per day, lower than the average in 2018 (at 1,272 thousand dongs). Both overnight visitors stay at commercial and non-commercial accommodations spend around 4 days on the trip.

By the end of 2019, there were 30 thousand tourist accommodations nationwide with more than 100,000 rooms. Some tourist destinations such as Da Nang, Hoi An, Nha Trang, Phu Quoc, etc., have appeared the world's leading international luxury resorts. On average, the 50-star hotels in Vietnam rate was 116.6 US dollars, higher than the rate in 2018 was at 113.9 US dollars; the 4-star hotel's rate in 2019 was 73.6 US dollars, higher than the rate in 2018 (72.7 US dollars). In 2019, 77.8% of guests who stayed in upscale hotels in Vietnam were foreigners, 22.2% were domestic guests.

At the end of 2019, Vietnam has 2,67 thousand tour operators, an increase of 49 hundred tour operators compared to the previous year.

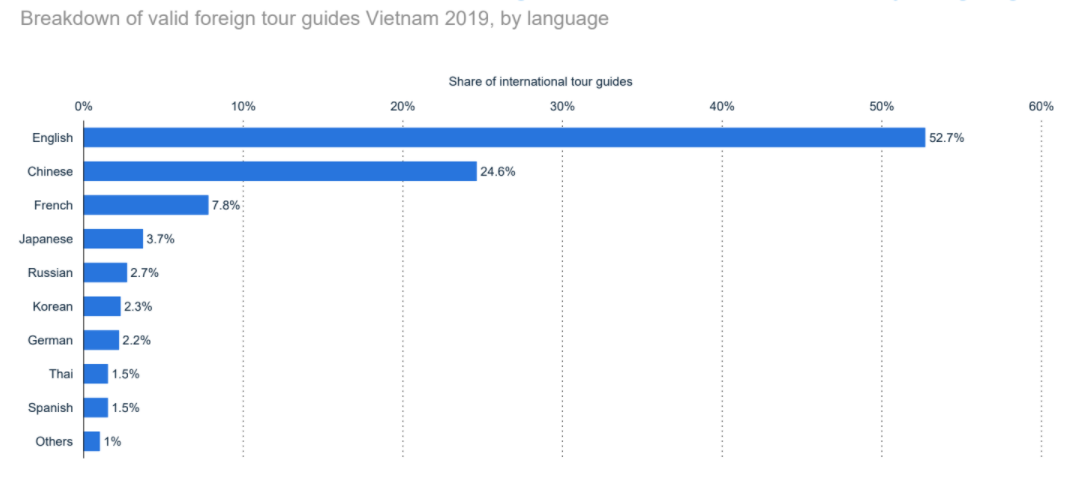

According to the report, there are currently 7.68 thousand licensed tour guides in Vietnam, broken down by language: 52.7% are in English, 24.6% in Chinese, 7.8% in French, 3.7% in Japanese, 2.7% Russian, 2.7% German, 2.3% Korean, etc. The imbalance between the number of international tour guides of different languages and the number of tourists leads to a local shortage of language guides popular in high seasons such as Korean, Japanese, and Russian.

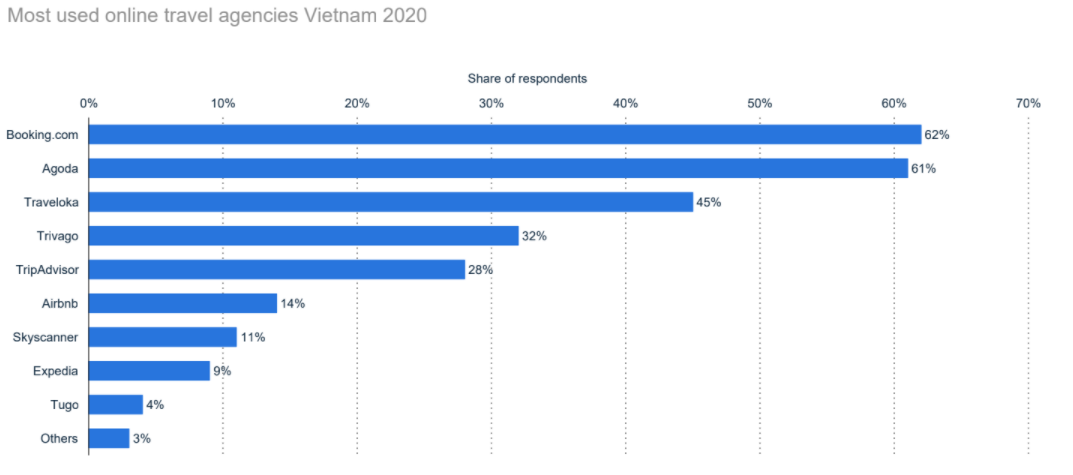

Although famous globally, especially in developed countries, OTA is still a new type in Vietnam. According to a survey by Rakuten Insight on online travel agencies (OTA) conducted in November 2020, 60% of Vietnamese respondents stated that they had used an online travel agency. Around 8% of them did not know what an online travel agent was.

Leading online travel agencies in Vietnam as of November 2020 are include: Booking.com (62%); Agoda (61%); Traveloka (45%); Trivago (32%); TripAdvisor (28%); Airbnb (14%); Skyscanner (11%); Expedia (9%); Tugo (4%) and others (3%). 80% of people who book tickets or services via an online travel agency use their smartphone, 58% use a laptop, and 16% use their tablet. This data shows that building a mobile-friendly website is extremely important to help OTAs attract users to achieve higher conversion rates.

The tourism industry is considered the most challenging sector hit by the pandemic among economic sectors. The spread of the disease and complicated developments globally have caused many countries to implement social distance and blockade.

Looking back at the impact of the Covid-19 epidemic on Vietnam's tourism, the number of international visitors to Vietnam from January 2020 to October 2020 shows a sharp drop. In January, international visitors to Vietnam decreased sharply, reaching nearly 14,819 people, down 91.6% compared to October 2019. The hotel occupancy rate in the first half of 2020 was at 29%, down 32% compared to 2019.

The epidemic has changed tourists' behavior in many aspects. Accordingly, tourists tend to pay more attention to health safety, travel insurance, avoiding crowded contact, increasing demand for high-end resorts in open and isolated spaces; instead of prioritizing price, customers will prioritize safety and choose high-quality travel products. The negative impacts of the pandemic on the tourism industry in 2020 were so heavy. However, the pandemic also opens up many opportunities for the tourism sector to overcome challenges. To see detailed research data, you can download the full report here. For more information, don't hesitate to contact email partner@iris.marketing or phone (+84) 888 239 444.