The FMGC report from Statista gives us comprehensive data about the FMCG industry in Vietnam in 2020 with a forecast for 2021.

Thanks to a good response as soon as the pandemic broke out, Vietnam's economy is among the top 10 countries with the highest GDP growth in 2020 and has a brighter outlook in 2021. However, at this time, in Oct 2021, the fourth wave of the Covid-19 pandemic after the Tet holiday is still complicated, despite Vietnam's strong epidemic prevention methods. This has a profound effect on the market economy, especially the FMCG industry. The FMCG report from Statista gives us comprehensive data about the FMCG industry in Vietnam in 2020 with a forecast for 2021.

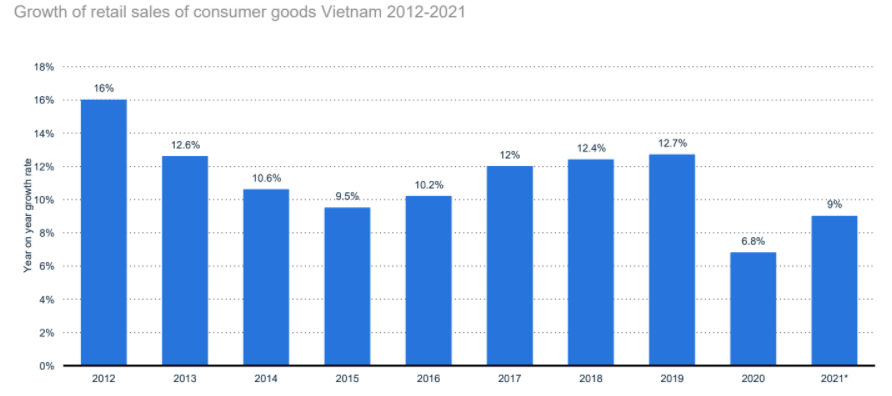

According to data reported by the General Statistics Office of Vietnam, Kantar Worldpanel, from 2012 to 2020, the retail sales growth of consumer goods recorded many changes. In 2020, the growth of retail sales decreased nearly 50% compared to the previous year. In 2021, it was forecast for a positive recovery in 2021 despite being lower than the period from 2012 to 2019. This is explained due to business activities, and foreign investment is still affected by the pandemic.

With the new wave of pandemics begun in May, Vietnam's economy will likely face many risks and challenges in the last 6 months of 2021.

Monthly FMCG expenditure in Vietnam from 2012 to 2020 shows a continuous increase in urban and rural areas. According to the report, the monthly FMCG expenditure in the urban area reached about 1.43 million VND, while in the rural the amount of FMCG spending at around 0.85 million VND in 2020. The monthly FMCG expenditure in Vietnam was predicted to reach 1.5 million VND in urban and 1.04 million VND in 2025.

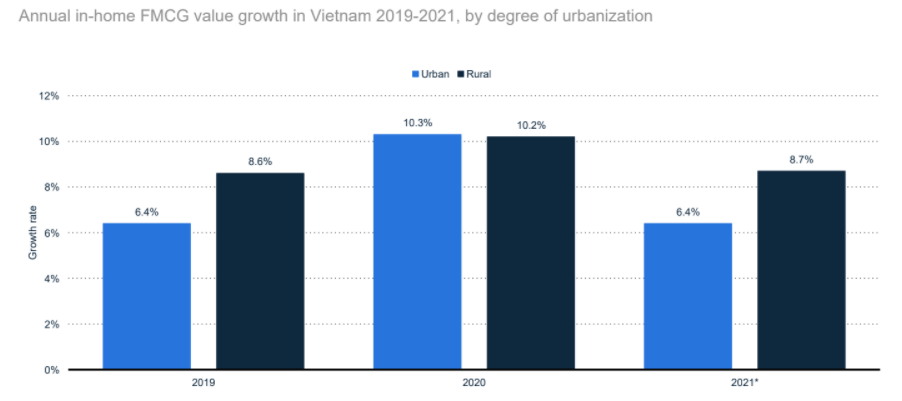

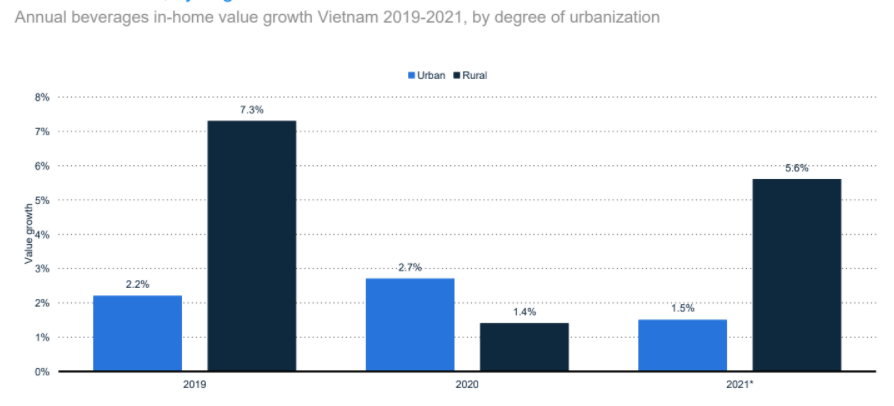

Annual in-home FMCG value growth

The annual in-home FMCG value growth in 2020, both in urban and rural areas were higher compared to 2019 and predicted to decrease in the next year as consumers can reduce shopping, due to the impact of the pandemic and especially in the central region, which is being affected by storms and floods.

In 2020, the annual in-home FMCG value growth was equally in rural and urban areas, in contrast to 2019, while rural showed a higher value growth than in urban.

Most chosen FMCG brands

There are differences in the most chosen FMCG brands in Vietnamese urban and rural areas. In urban areas, Vinamilk has the highest penetration rate, followed by Hao Hao noodle and Ajinomoto, with the penetration rate being 78% and 75%, respectively. Cocacola, TH True Milk, Milo, and Ngoi Sao Phuong Nam are other drink brands with high penetration rates in urban areas.

In rural areas, P/S - Teeth Care brands under Unilever have the highest penetration rate at 83%, followed by ChinSu, Nam Ngu, and Vinamilk with 77%, 75%, and 73%, respectively. In contrast to urban areas, the rural residents show the most concern in noodle brands, including 3 Mien, Gau Do, Hao Hao brands instead of milk brands.

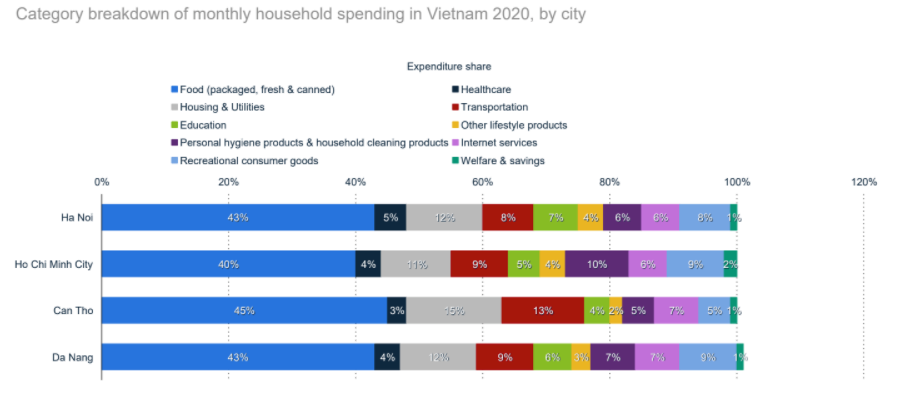

The FMCG monthly household expenditure in four big cities, including Ha Noi, Ho Chi Minh City, Can Tho, Da Nang, showed the highest in Food categories at more than 40%, followed by Transportation, Recreational consumer goods, Internet services, Personal hygiene products & household cleaning products.

The dairy category accounts for the highest in-home FMCG value in urban areas, accounting for 28.9%. Followed by Packaged grocery, accounting for 25.2%, beverages accounting for 19%, personal care 17.9%, and homecare with 9%. Besides, the packaged foods have the highest value growth rate in 2020, followed by the personal care category with a growth rate of 12%, following are dairy, home care, and beverage.

Packaged grocery is the highest in-home FMCG category value in rural areas accounting for 30%; the next category is beverages accounting for 24.1%; dairy, personal care, and home care are 23.8, 13.1%; and 9%, respectively. In rural areas, personal care has the highest value growth rate at 16%, followed by packaged foods with 15%, dairy with 13%, homecare and beverages are 11% and 1%, respectively.

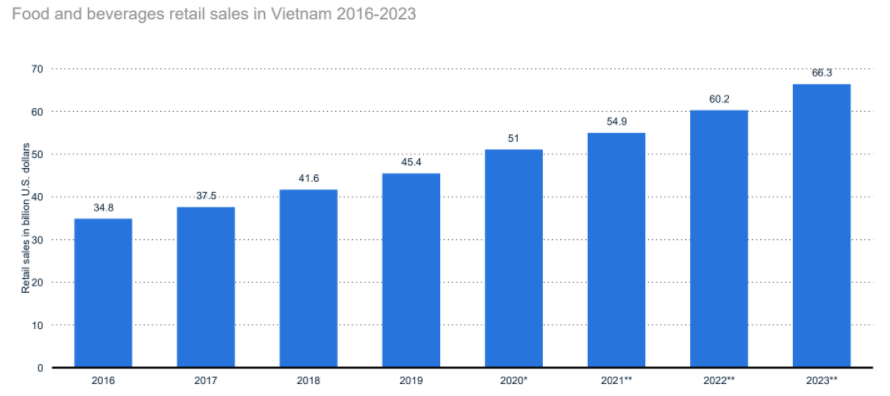

Vietnam is one of the largest food consumers in Southeast Asia, with the growth rate of the retail sales of food and beverages in the period 2016-2020, averaging 4%, with the highest proportion coming from fresh food, followed by packaged food, non-alcoholic drinks, and alcoholic drinks.

The packaged grocery's annual value growth in Vietnam 2020 was at 21.3% in urban areas, increasing 16.4% compared to the previous years. In rural areas, the annual value growth of packaged grocery is 13.6% in 2020, increasing 8.4% compared to 2019. In 2021, it is forecast that there will be a decrease in annual value growth due to the impact of the Covid pandemic.

The value growth of beverages products in Vietnam in 2020 is 2.7%, while this figure is lower in rural areas, 1.4%. However, the Covid epidemic is predicted to impact significantly urban areas in 2021, causing the growth rate of beverages in urban areas to decrease sharply, while rural areas show a higher beverage value growth.

Hao Hao, Ajinomoto, Maggi, Nam Ngu, Chin Su are the most chosen FMCG brands in the food category in urban areas in Vietnam in 2020. There is a difference in the level of preference for these brands in urban and rural areas.

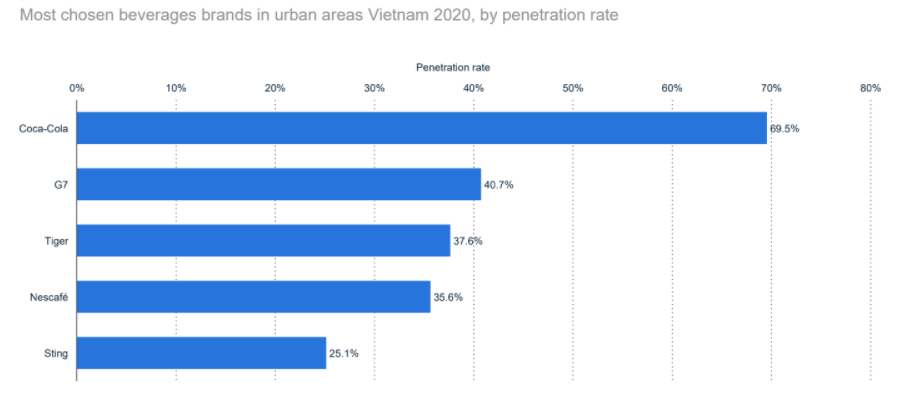

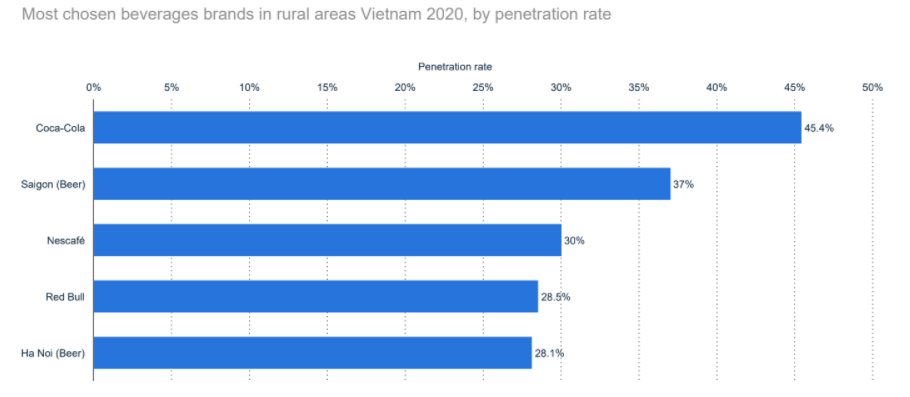

The beverage category's preferred beverage brand in urban and rural areas is Coca-Cola, followed by coffee and beer brands. In urban areas, G7, with a penetration rate of 40.7%, and Nescafe, with a penetration rate of 35.6%, are 2 coffee brands with a high penetration rate, including Tiger (beer) with a penetration rate of 37.6%, Sting 25.1%. In rural areas, Saigon (beer) is the second most famous brand with a penetration rate of 37%, followed by Nescafé, Red Bull, Ha Noi (Beer) Ha Noi with a penetration rate of 30%, 28.5%, 28.1%, respectively.

Figure 1. The most chosen FMCG brands in the beverages category by consumers in urban areas in Vietnam in 2020

Figure 2. The most chosen FMCG brands in the beverages category by consumers in rural areas in Vietnam in 2020

According to YCP Solidiance; Euromonitor, Invest & Export Brazil, the production volume of total dairy products in Vietnam from 2016 to 2020 increased steadily and forecasts to increase continuously to 2023. In 2020 the total dairy products production volume reached 1.83 million metric tons, an increase of 0.16 million metric tons compared to 2019, and predicted to reach 2.43 million metric tons in 2023.

The retail sales value of total dairy products in Vietnam increased through the year from 2016 to 2020. In 2020, the retail sales value of total dairy products in Vietnam reached 3.85 billion U.S. dollars, increasing 0.26 billion U.S. Dollars compared to the previous year.

Drinking milk products bring the highest retail sales value for the dairy category, reaching 2.56 billion U.S. dollars, and yogurt and sourced milk products made 0.82 billion in retail sales. Cream and condensed milk with 0.36 billion U.S. dollar, Cheese and Butter and spreads with 0.1 and 0.01 billion USD respectively.

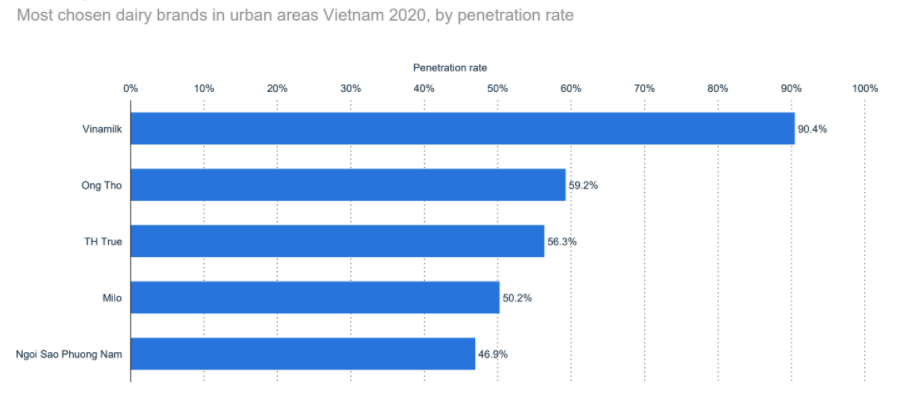

The most chosen FMCG dairy brands in urban areas including Vinalmilk with the highest penetration of 90.4%, Ong Tho (Vinamilk) with 59.2%, T.H. True Milk with a penetration rate of 56.3%, Milo (Nestle), and Ngoi Sao Phuong Nam (Vinamilk) are 50.2% and 46.9% respectively.

In rural areas, Vinamilk is still the most chosen brand which has the highest penetration rate like urban areas, which accounted for 73.2%, Fami (Vinasoy) with the penetration of 50%, Ong Tho (Vinamilk), Milo (Nestle), Ngoi Sao Phuong Nam (Vinamilk) with the penetration 47.9%, 33.5%, and 25.7% respectively.

The report points out the decrease in production volume of some personal care categories in Vietnam within 2 years due to the pandemic. In shampoo and conditioner, the production volume increased steadily from 2010 to 2017 and recorded a decrease of 4.9 thousand metric tons in 2018 compared to the previous year. The production volume remains around 64 thousand metric tons, lower than the average of the decade.

At the same, the production volume of toothpaste is uneven growth. It showed a substantial increase from 2010 to 2012 and decreased in 2013, then increased steadily to 2018 at 49.3 thousand metric tons before decreasing again to 38.99 thousand tons in 2020.

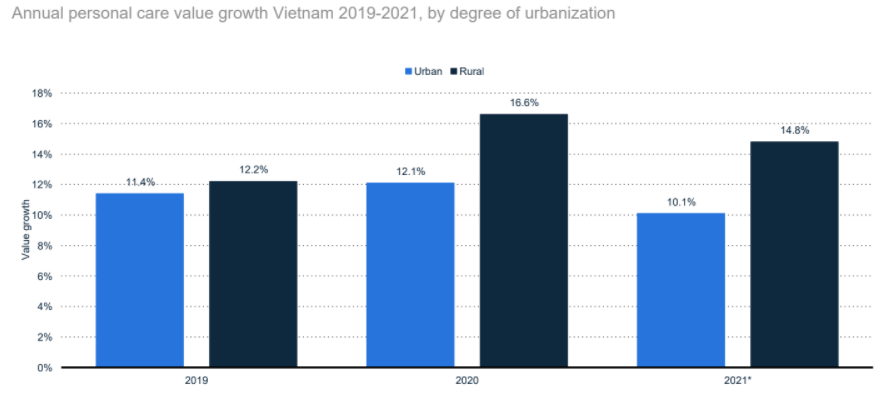

The value growth of personal care products in rural areas in 2020 shows a high increase of 4.4% compared to the previous year. At the same time, urban areas show a slight increase from 11.4% in 2019 to 12.1% in 2020. It was forecast to significantly decrease in urban and rural areas annual in-home FMCG value growth of personal care in 2021 due to the bad effect of the pandemic.

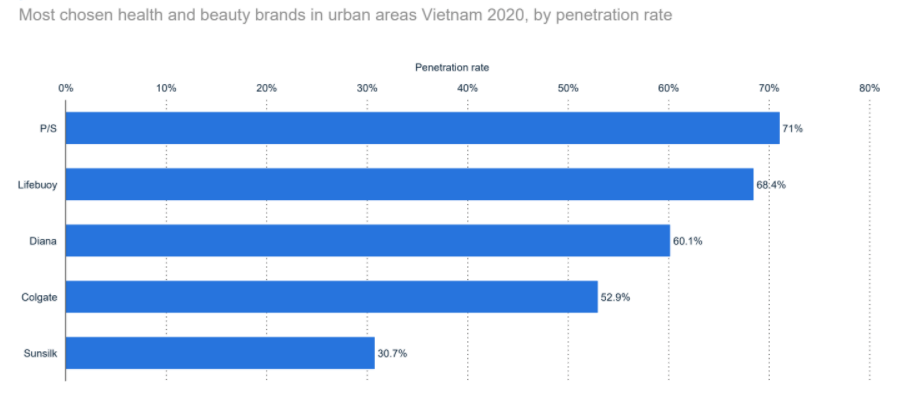

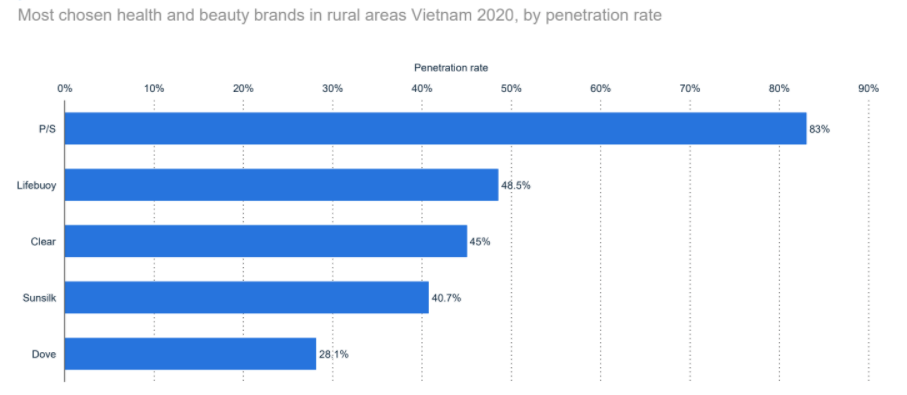

The preferred brand in the health and beauty category in urban and rural areas is P/S (penetration of 71%), followed by Lifebuoy (penetration of 68.4%).

In urban areas, other preferred brands include Diana (60.1%), Colgate (52.9%), Sunsilk (30.7%).

In rural areas, the most chosen brands include Clear, with a penetration rate of 45%, Sunsilk, and Dove in rural areas with 40.7% and 28.1%, respectively.

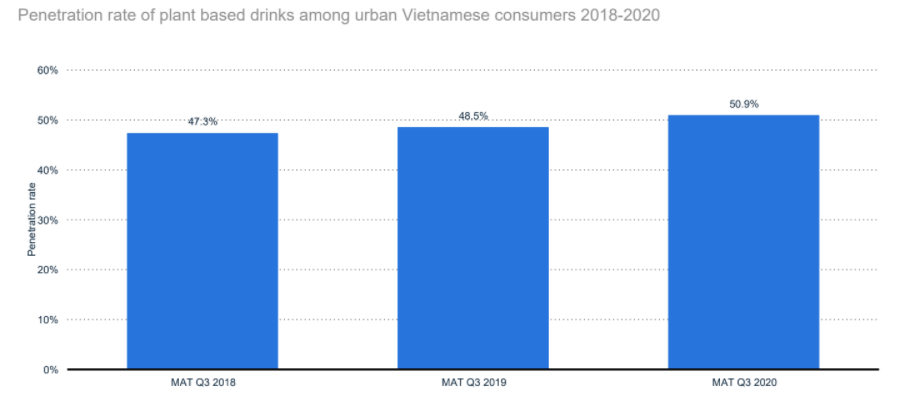

The Statista report pointed out the high penetration rate of plant-based drinks among urban Vietnamese consumers from 2018 to 2020.

Using natural-origin products, a healthy diet brings many benefits to human health. Kantar surveyed the Vietnamese market, and the results show that 89% of households in big cities/towns are aware that they are currently interested. Healthier than before, and 71% said that they prefer to buy sugar-free and low-sugar drinks. This will be an excellent opportunity for the beverage market in Vietnam.

The volume share of plain liquid milk consumption among consumers in Vietnam increased steadily through the year from 2019 to 2020. Less sweetened liquid milk consumption shows a substantial increase in volume share in 2020 compared to previous years.

The CRP growth of nature and sensitive home products in urban Vietnam 2020 was highest in fabric softener products at 170.9%, dishwashing liquid with 38.1%, and Detergent with 59%.

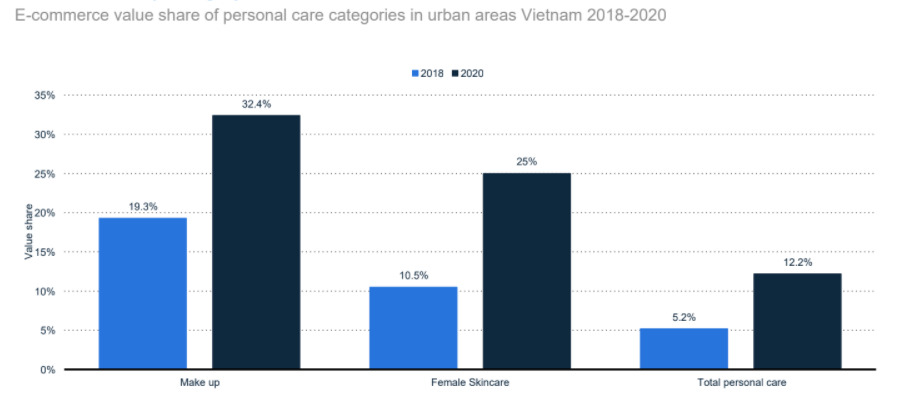

The data show the increase in value shared e-commerce of personal care products among urban consumers in Vietnam from 2018 to 2020. The total personal care product in urban areas in 2020 at 12.2%, an increase of 5.02% compared to 2018 (volume share of 5.2%). The volume share of the makeup category in 2020 at 25%, an increase of 13.1% compared to 2018. In female skincare categories, the volume share of eCommerce products in 2020 reached 25%, an increase of 14.5% compared to 2018.

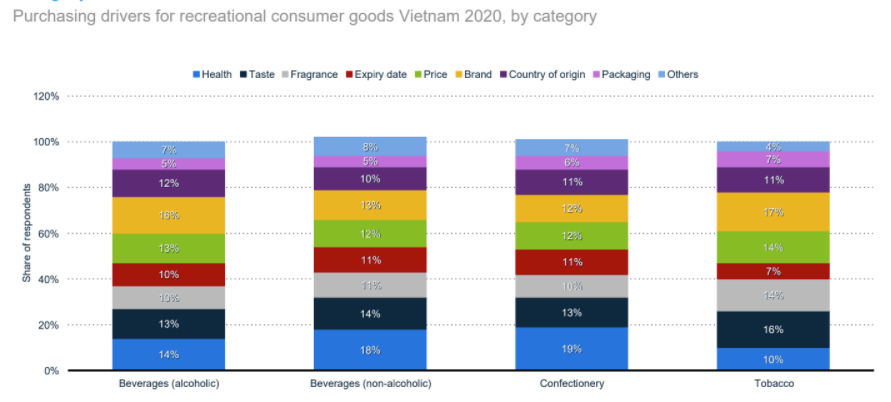

For recreational consumer goods, Vietnamese's main attributes driving purchase behavior were health (14%) for alcoholic and (18%) non-alcoholic beverages categories, 19% by Health for Confectionery and 17% by brand for Tobacco.

Consumer confidence declines, and inadequate finances, leading to a need to save to spend more carefully, setting aside a contingency for the unforeseen.

It can be seen that the pandemic has promoted planned and intentional shopping and a shift to sustainable and rational consumption.

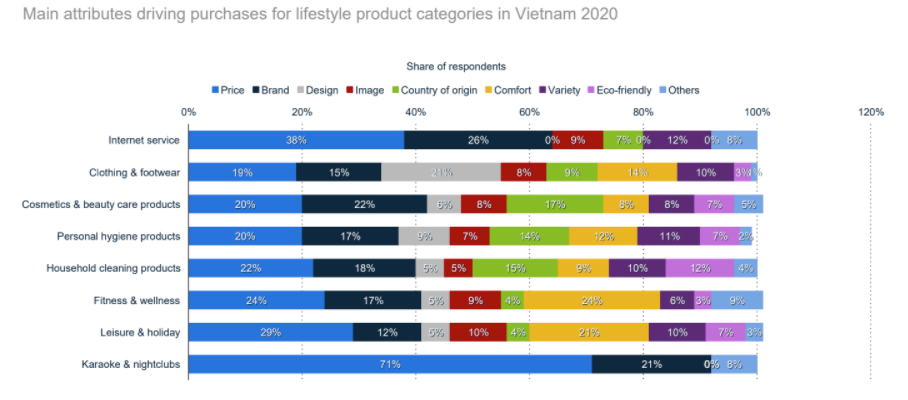

According to Statista's survey, Price is the main attribute driving purchase behavior for lifestyle products in Vietnam for Internet service, Personal hygiene products, household cleaning products, Leisure & holiday, and Karaoke & nightclubs. The brand is the following important attribute driving purchase behavior for Internet service, Cosmetics & beauty care products, Personal hygiene products, household cleaning products, Karaoke & nightclubs.

The Covid-19 pandemic, with its complicated and difficult-to-control developments, has severely affected all global economies. Protectionism has begun to increase; many countries have imposed barriers to the export of medical products and reduced tariffs on agricultural imports to maximize the supply of vital goods for the domestic market. This is also changing the organization of global social life, most clearly reflected in modern consumption trends. People tend to be more interested in food and health products because these items are essential in protecting health and maintaining life before the epidemic spreads with more dangerous variants.

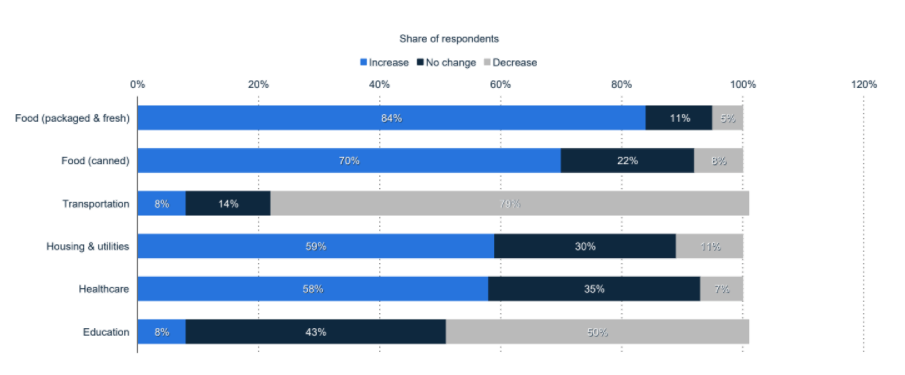

Food (packaged & fresh) and Healthcare and Housing & utilities products are the highest expenditure categories among consumers in Vietnam. Meanwhile, 79% of respondents indicated that they would decrease their spending on transportation.

Covid-19 has affected almost every aspect of consumers' personal lives, making businesses creative and reacting quickly to adapt to people's new trends and ways of consumption. The report from Statista shows us the most prominent trends in modern consumer trends that changed due to the pandemic. Download the Full report to get detailed information about the consumer market overview in Vietnam 2020 and consumer trends in the next few years.